Numerical example

Consider a Stable Pool containing USDC and USDT, where USDT has slightly de-pegged (say, to 0.98).

p₁ = $1.00 (USDC), p₂ = $0.98 (USDT)

A = 100, D = 1000 (invariant)

Step 1: Calculate the parameters (amplification coefficient, and "helper" constants derived from the Amplification parameter)

a = A × n^(2n) = 100 × 2^4 = 1600

b = a - n^n = 1600 - 2^2 = 1596

c = b/a = 1596/1600 = 0.9975

Step 2: Calculate the r values (scaled prices)

r₁ = p₁/a = 1.00/1600 = 0.000625

r₂ = p₂/a = 0.98/1600 = 0.0006125

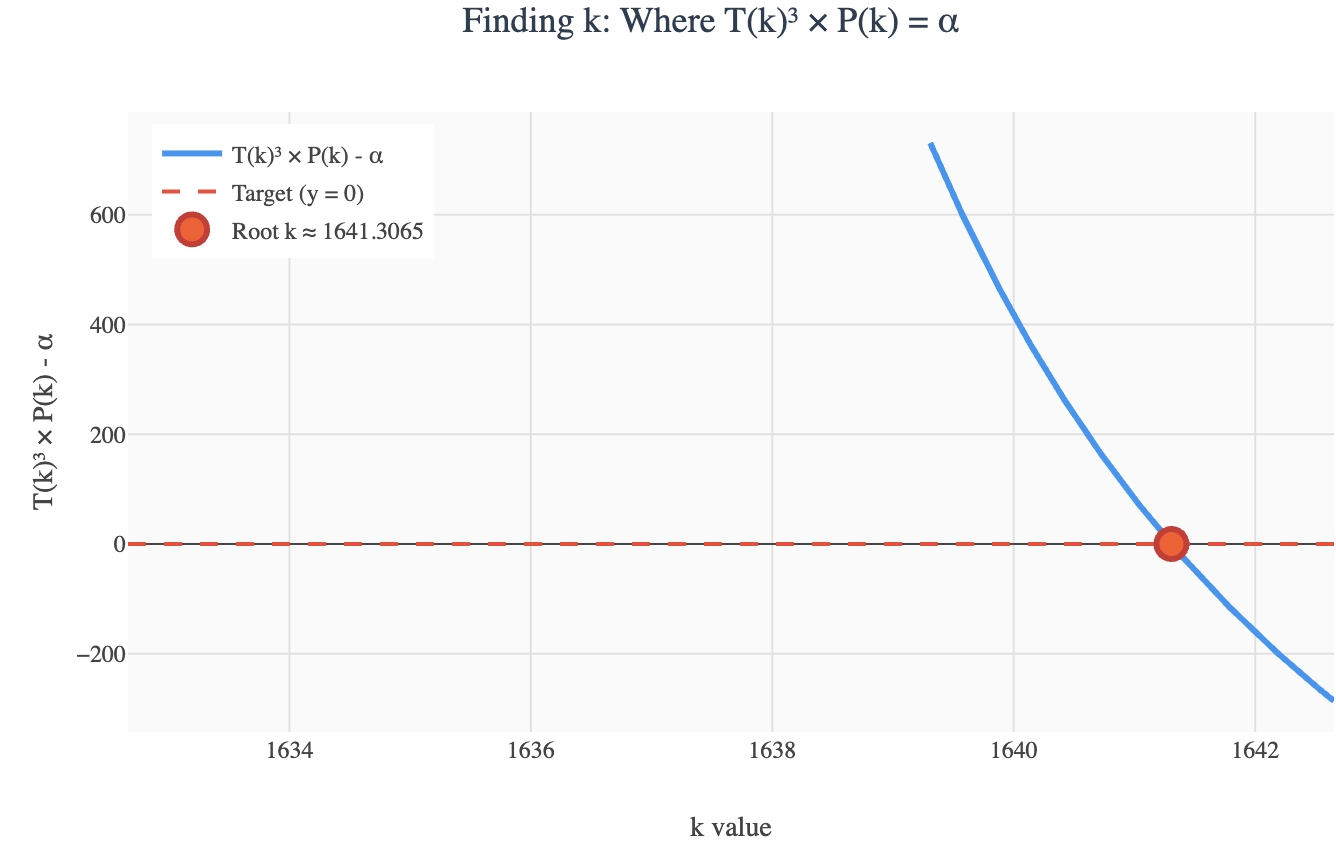

Step 3: Find the root, using Newton's method:

Choose the starting point: k₀ = (1 + 1/(1+b)) × ρ

k₀ = (1 + 1/(1+1596)) × 1633 = (1 + 1/1597) × 1633 ≈ 1634.02

Newton's method:

kₙ₊₁ = kₙ − G(kₙ) / G′(kₙ); where

G(k) = T(k)³ × P(k) - α

G'(k) = T²(k) × P(k) × [(3T'(k) × P(k) + T(k) × P'(k))/P(k)]

And: T'(k) = -r₁/(kr₁-1)² - r₂/(kr₂-1)²

P'(k) = P(k) × [r₁/(kr₁-1) + r₂/(kr₂-1)]

First iteration (k₀ = 1634.02)

Calculate T(1634.02):

T = 1/(1634.02×0.000625-1) + 1/(1634.02×0.0006125-1) - 1

T = 1/(1.0213-1) + 1/(1.0008-1) - 1

T = 1/0.0213 + 1/0.0008 - 1 = 46.95 + 1250 - 1 ≈ 1295.95

Calculate P(1634.02):

P = (1634.02×0.000625-1) × (1634.02×0.0006125-1)

P = 0.0213 × 0.0008 ≈ 0.000017

Calculate G(1634.02): the "error"

G = (1295.95)³ × 0.000017 - 1588.03

G = 2.17×10⁹ × 0.000017 - 1588.03 ≈ 36,890 - 1588 ≈ 35,302

Calculate derivatives and find k₁:

T' = -0.000625/(0.0213)² - 0.0006125/(0.0008)² ≈ -1380 - 956 ≈ -2336

G' ≈ ... (complex calculation) ≈ 50.8

k₁ = 1634.02 - 35,302/50.8 ≈ 1634.02 - 694.9 ≈ 939.1

Continue iterations:

| Step | k̃ₙ | G(k̃ₙ) | k̃ₙ₊₁ |

|---|---|---|---|

| 0 | 1634.02 | 35,302 | 939.1 |

| 1 | 939.1. | -285.4 | 1425.7 |

| 2 | 1425.7 | 892.1 | 1580.3 |

| 3 | 1580.3 | 124.7 | 1635.8 |

| 4 | 1635.8 | 8.2 | 1640.1 |

| 5 | 1640.1 | 0.1 | 1641.0 |

| 6 | 1641.0 | ~0 | 1641.0 |

Graphical representation of the T curve:

Step 4: Calculate T (using our found k̃ = 1641)

Recall that T = 1/(k̃r₁ - 1) + 1/(k̃r₂ - 1) - 1

T = 1/(1641 × 0.000625 - 1) + 1/(1641 × 0.0006125 - 1) - 1

T = 1/(1.025625 - 1) + 1/(1.0051125 - 1) - 1

T = 1/0.025625 + 1/0.0051125 - 1

T = 39.02 + 195.60 - 1 = 233.62

Step 5: Calculate effective balances

Recall that x₁ = (cD)/(k̃r₁ - 1) × T⁻¹

x₁ = (0.9975 × 1000)/(1641 × 0.000625 - 1) × (1/233.62)

x₁ = 997.5/0.025625 × (1/233.62) = 166.69

x₂ = (cD)/(k̃r₂ - 1) × T⁻¹

x₂ = (0.9975 × 1000)/(1641 × 0.0006125 - 1) × (1/233.62)

x₂ = 997.5/0.0051125 × (1/233.62) = 833.31

Step 6: Calculate total pool value

Recall that Pool Value = p₁ × x₁ + p₂ × x₂

Pool Value = $1.00 × 166.69 + $0.98 × 833.31

Pool Value = $166.69 + $816.64 = $983.33

Step 7: Calculate BPT price

Recall that BPT Price = Pool Value / Total BPT Supply

(If total BPT supply = 1000 tokens, since D = 1000, and starting prices were nominal at $1)

BPT Price = $983.33 / 1000 = $0.983 per BPT