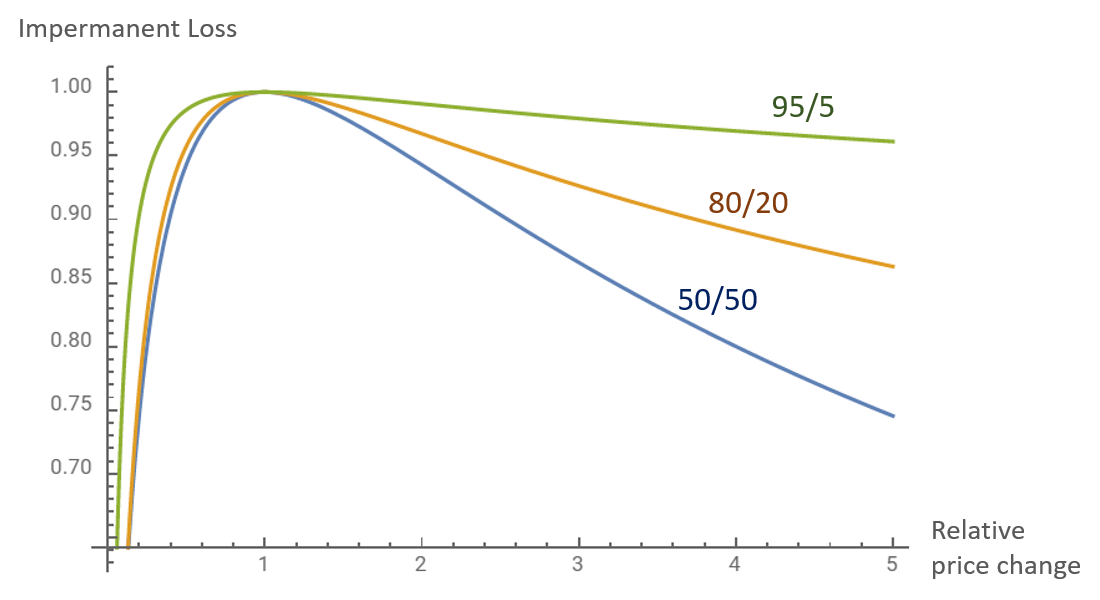

Impermanent Loss

Impermanent Loss, sometimes referred to as divergent loss, is simply the opportunity cost of adding liquidity into an AMM pool vs. holding the individual tokens.

Impermanent loss occurs when the prices of two assets diverge in price after initial liquidity provision. For example, if all assets in a pool increase by 20%, there is no impermanent loss. However, if only one asset increases in value by 20%, uncorrelated with the other tokens, there will be some impermanent loss. It is "impermanent" because it can be reversed; e.g., if the asset returned to its initial value, or the other tokens also increased 20%. For a basic example of impermanent loss followed by a reversal, see the next page.